An exchange-traded fund (ETF) is an open-end investment company (mutual fund) or unit investment trust (UIT) whose shares trade on the secondary market in intraday trading at its intraday indicative value (IIV). Most are index based, while some are actively managed.

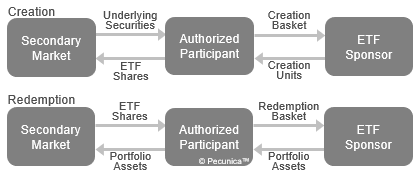

To create an ETF, a sponsor (investment company) enters into contractual relationships with one or more authorized participants (APs). The APs – exchange specialists, market-making dealers or clearing brokers – initially contribute creation baskets of the underlying securities and/or cash to the sponsor in exchange for creation units of equally valued blocks of ETFs from the sponsor.

| ETF Operation Process |

Source:

|

Serving as inventory, the APs then buy and sell (trade) the ETFs in the secondary market. APs may redeem the shares with the ETF sponsor on a daily basis in a redemption basket of creation units in exchange for the underlying securities and cash of equal value.

A unit investment trust (UIT) is a US investment company that is organized under contract, custodianship, agency or similar instrument. UITs do not have either a board of directors or board of trustees, officers or an investment adviser during their life.

UITS issue only nonvoting redeemable securities (units), each of which represents an undivided interest in a portfolio of passively held assets. They are either fixed or nonfixed. The units are not actively traded.

A fixed UIT buys a relatively fixed portfolio of securities and holds them with little or no change for its life. They must be redeemed at their approximate net asset value (NAV) with the UIT sponsor upon an investor’s request. Fixed UITs automatically terminate and dissolve when the underlying assets mature. Some exchange-traded funds (ETFs) are structured as fixed UITs

| UITs as Exchange-Traded Funds on 6 Sept 2017 (Example) | |||||

| Symbol | Name | Price | Assets | Avg. Vol. | YTD |

| SPY | SPDR S&P 500 ETF | $246.06 | $238,256,842 | 64,438,773 | 11.10% |

| QQQ | PowerShares QQQ | $144.69 | $53,101,762 | 39,572,098 | 22.71% |

| MDY | SPDR S&P MidCap 400 ETF | $313.33 | $17,872,177 | 1,157,852 | 4.29% |

| DIA | SPDR Dow Jones Industrial Average ETF | $217.67 | $17,530,207 | 2,559,331 | 11.85% |

| Source: ETFdb | |||||

A nonfixed UIT is a contractual plan established for the contractual periodic investing of a fixed amount in mutual funds over an extended period of time (e.g., 10-15 years). They hold the shares for the benefit of the investors and issues redeemable periodic payment plan certificates representing ownership interest in the periodic payment plan.