The income of investment funds can result through cash dividends, interest income, and capital gains realized on fund portfolio:

- Cash dividend – The distribution of a company's net income after taxes to investment funds and its other shareholders in the form of cash;

- Interest income – The interest earned by funds and received on the debt instruments, such as bonds, money market instruments and loans, in their portfolio; and

- Capital gain – The profit earned and realized by investors through price appreciation of their investments above the purchase price less transaction costs when sold.

| Short-Term and Long-Term Capital Gains |

Source:

|

If the market value of a fund’s portfolio increases due to dividends, interest income or capital gains on its assets and after deduction of expenses and liabilities, then the fund’s NAV and the price of its shares also increase. Dividends and interest received and capital gains are consolidated in a fund’s daily net asset value until the payout date.

Net asset value (NAV) is the per-share value of the assets of an investment fund minus its . NAV is computed after receipt of the purchase or redemption order at least once daily for mutual funds and ETFs.

A capital gain is realized at the fund level when it sells a portfolio investment that has appreciated above the asset’s net purchase price. Most investment companies are required to distribute to current shareholders any net capital gains it has realized on the sale of portfolio securities at the end of the year.

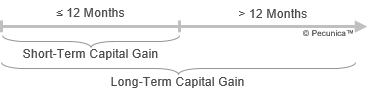

If a capital gain is realized on a fund investment held for over one year, it is a long-term capital gain (LTCG) and generally taxed at the fund level. If a short-term capital gain (STCG) is realized on an investment held for a year or less, it is treated as a cash dividend and passed on to fund investors without taxation.

US funds are not subject to US federal income tax at the fund level if they satisfy certain tax requirements and distribute all their income to shareholders.