A bond that is backed by one or more assets of the issuer to secure the payment of interest and the repayment of the principal is a secured bond. Because government securities are unsecured, a secured bond typically refers to a corporate bond. Secured corporate bonds in the US market are typically classified according to the nature of the asset securing them as mortgage bonds, collateral trust certificates and equipment trust certificates.

Collateral is a specific asset or group of assets assigned or pledged by a borrower to secure an obligation until it is repaid. In the event of the issuer’s default on a secured bond, the bondholders are entitled to seize the collateral (through the designated bond indenture trustee of US registered bonds) and sell it, with the resulting proceeds used to satisfy the bondholders’ remaining claims on the issuer. Pledging or assigning high-quality collateral to secure a bond issue reduces the risk to the bondholders and, therefore, results in a relatively low rate of interest (low yield) on the bond compared to the use of lower-quality collateral.

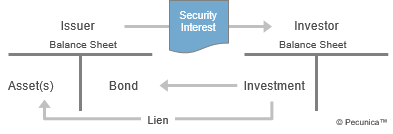

| Collateral Securing a Bond |

Source:

|

A bond secured by specific assets set aside to retire all or part of the bond issue by the maturity date is a sinking fund bond, where the amount retired is delivered to the bond trustee either in the form of bonds bought in the open market or cash for a call by lottery. A provision in a corporate bond indenture requiring the issuer to retire a specified amount of the issue each year in order to reduce credit risk is a sinking fund.

Leave A Comment

You must be logged in to post a comment.