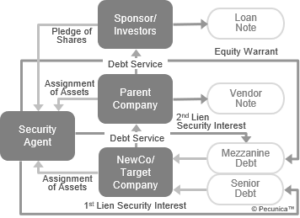

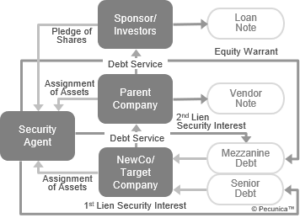

| Structural Subordination (Example) |

Source:

|

If the parent company in a special-purpose vehicle (SPV) is set up exclusively for the financing, its revenues consist substantially or wholly of dividends on equity or payments on downstream loans since it has no operating revenues of its own. If the operating subsidiary makes no distribution to the holding company, no funds may be available to the parent company to pay the lender.

Structural subordination is typical of leveraged and real estate investment finance. In real estate finance, the mezzanine loan is advanced, pursuant to a separate mezzanine facility agreement, to the holding company (HoldCo) of the PropCos while the senior loan (“PropCo loan”) is advanced to the borrowers and the companies that own each individual property (PropCos). Since the HoldCo is higher up the corporate structure and structurally removed from the assets held by the PropCos, it is structurally subordinated. This structurally subordinated entity (HoldCo) only has recourse to the shares in its subsidiaries (PropCos) and receives payment only after the senior loans to the PropCos has been serviced.

Leave A Comment

You must be logged in to post a comment.