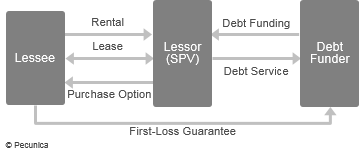

A synthetic lease is a financing specially structured to be treated as a nontax lease (conditional sale, loan, financing) for tax purposes but as an operating lease for accounting purposes, in order to achieve the tax benefits for the lessee of owning the financed asset while having off-balance sheet accounting treatment of the financing. Synthetic leases are so structured to take advantage of inconsistencies in accounting and tax rules for the benefit of the lessee. Whereas the lessee provides a first-loss guarantee for the first loss incurred on the residual value of a leased asset for a maximum amount, the lessor’s risk position is large enough – at least 10.1% of the residual value on a present value basis under IRS tax rules – for it to be classified as an operating lease.

| Leverage Synthetic Lease Structure |

Source:

|

Synthetic leases are commonly used for high-volume small-ticket equipment via a master lease and through the use of a special purpose vehicle (SPV). The SPV is usually owned by the lessee/operating company and given just enough independence such that it is not consolidated with the operating company on its balance sheet. The leases are recorded as an asset on the balance sheet of the SPV, which allows the SPV to take advantage of the tax benefits of ownership while the equipment is leased to the operating company under an operating lease for accounting purposes, allowing the lessee to recognize the lease payments as expense.

Leveraged synthetic leases are nontax leases that are leveraged with third-party nonrecourse funding, usually for real estate and big-ticket equipment. They must be big-ticket deals to justify the expense of structuring and arranging the transactions. FASB Fin 46(R) eliminated the use of SPVs as the lessor vehicle for leveraged synthetic leases.

Leave A Comment

You must be logged in to post a comment.