In June 2016, the FASB introduced the expected credit loss model (CECL model) to become effective on 1 January 2020 for public business entities that are Securities and Exchange Commission (SEC) filers for fiscal years beginning after 15 December 2020 for all other entities. Entities can early adopt the new standard in fiscal years beginning after 15 December 2018.

The financial instruments included within the scope of the FASB CECL model are:

- Loans, trade receivables and debt securities classified as held-to-maturity;

- Loan commitments that are not measured at fair value through net income (FV-NI);

- Off-balance-sheet credit exposures and financial guarantee contracts that are not accounted for as insurance contracts or at fair value through net income;

- The net investment in a sales-type or a direct financing lease;

- Reinsurance receivables; and

- Contract assets in the scope of Topic 606 “Revenue from Contracts with Customers”.

The CECL model requires entities to recognize lifetime expected credit losses for all assets and follows a single credit-loss measurement approach. Recognition of credit losses is required only when the fair value is less than the amortised cost, regardless of their credit risk at the reporting date as compared with initial recognition.

| Recognition of a PCD Financial Asset under CECL (Example) | ||||

| YourBank pays $75,000 for a loan with an unpaid principal balance of $100,000 on July 1 2017. It is a HFI loan measured at amortized cost*. At the time of purchase, the allowance for credit losses on the unpaid principal balance is estimated to be $17,500. | ||||

| 1 Jul 17 | Loan (HFI) – Unpaid Principal Balance | 100,000 | ||

| Loan (HFI) – Noncredit Discount† | 7,500 | |||

| Allowance for Credit Losses | 17,500 | |||

| Cash | 75,000 | |||

| To recognize the purchase of a PCD loan | ||||

| * Amortized cost = Allowance for Credit Loss + Cash | ||||

| † The difference between par of $100,000 and the amortized cost of $92,000. | ||||

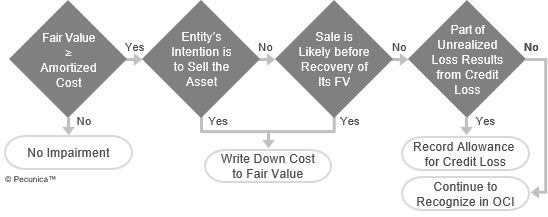

An other-than-temporary impairment (OTTI) charge is taken on available-for-sale and held-to-maturity instruments whose fair value has fallen below their amortized cost and is not expected to recover through the assets’ holding period. The impairment loss in certain situations that involve debt securities is split between profit or loss and OCI; otherwise, the OTTI is recognized in profit or loss.

| US GAAP Recognition of Credit Loss |

Source:

|

Equity securities without a readily determinable fair value and that do not qualify for use of the net asset practical expedient to estimate fair value under ASC 820, Fair Value Measurement – cost less any impairment – may be measured using the measurement alternative, which is cost less impairment plus/minus changes in observable prices for the same or a similar security.

| Practical Expedient Applied to FV-OCI Assets | |

| Cost > FV | Record allowance for ECL |

| Cost ≤ FV | No allowance for ECL |

Leave A Comment

You must be logged in to post a comment.