The annual percentage rate (APR) is the interest rate charged annually for financing, expressed as a percentage, representing the annual cost over the lease term, including all initial direct costs associated with the transaction. In leasing, the APR is based on the leased asset’s fair value, lease payments, residual value and the lease term. The APR is useful when comparing two or more loans or finance leases with different rates and fee structures.

| APR on a 5-Year 10,0000 Loan under Different Scenarios | |||||

|---|---|---|---|---|---|

| Total Loan | Interest Rate | Finance Charges | EIR | APR | Total Payable |

| 10,000 | 5.00% | $100.00 | 5.12% | 5.55% | $11,322.74 |

| 10,000 | 5.05% | $75.00 | 5.17% | 5.49% | $11,336.49 |

| 10,000 | 5.10% | $50.00 | 5.22% | 5.44% | $11,350.25 |

The rate that expresses the total cost to the lessee for leasing an asset as a percentage or decimal equivalent used to determine monthly payments is the lease rate factor (LRF), it including all lessor-related costs and margins for a given leased asset. It is convertible to an annual percentage rate by multiplying it by 2400 if presented as a decimal number. No US federal standard exists for calculating lease rates and lessors do not have to disclose to lessees the factors or the implicit rate they use in lease calculations.

Annual Percentage Rate = Lease Rate Factor x 2400

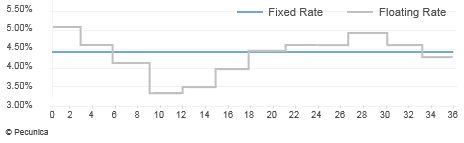

Lease payments may be fixed or variable over the lease term. Whether lease payments are floating or fixed generally depends on the lessee’s appetite for assuming interest-rate risk.

A lease whose annual percentage rate does not change and whose lease payments remain the same throughout the lease term is a fixed-rate lease. Whereas a fixed-rate lease does not expose the lessee to interest-rate risk on the transaction, its rate is generally higher at lease inception than on a comparable floating-rate lease as the cost (premium) for eliminating interest-rate risk. US finance leases tend to have fixed-rate rentals.

Fixed-Rate Lease = No Interest Rate Risk

A floating-rate lease is a lease whose interest rate is expressed as a fixed amount over an interest-rate index (e.g., LIBOR plus 150 basis points) and is subject to changes in the index during the lease term. The lease payments increase or decrease in proportion to rate changes, thereby exposing both the lessee and the lessor to interest-rate risk. Consequently, the interest cost of a floating-rate lease for the lessee and the interest revenue for the lessor ultimately depends on movement in interest rates over the lease term.

| Fixed- and Floating-Interest Rates |

Source:

|

Leave A Comment

You must be logged in to post a comment.