Any asset or liability that experiences a change in value due to changing interest rates is rate-sensitive. Repricing is a change in the interest rate on rate-sensitive assets (RSAs) and rate-sensitive liabilities (RSLs) due to an interest-rate reset on variable-rate and administered-rate instruments or the maturity, scheduled amortization or prepayment of assets or the maturity of liabilities. A variable-rate lease reprices – and subjects the lessor to interest rate risk – on its interest-rate change (reset) date.

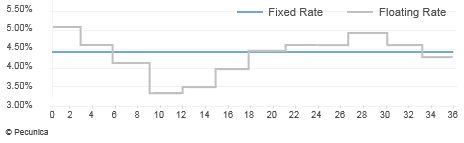

| Fix and Floating Interest Rates |

Source:

|

In order to provide level lease payments and eliminate repricing risk, leases generally have a rate that is fixed at lease inception for the entire lease term and repaid through periodic, equal lease payments. Interest rate risk results primarily from the difference in the timing of rate changes and cash flows. A lessor’s interest rate risk exposure is also affected by lease prepayment, early termination options and the asset’s residual value, all of which could prevent the lessor from fully recovering the investment in a lease and subject the lessor to reinvestment risk in a falling interest rate environment.

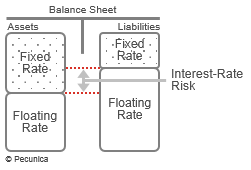

| Interest-Rate Risk |

Source:

|

Interest rate risk is normal and expected in leasing. Interest rate risk management is the process of prudently managing mismatched rate-sensitive asset and rate-sensitive liabilities in order to control, within set parameters, the impact of changes in interest rates on the positions. Asset-liability management (ALM) is used by lessors to determine the nature and size of potential interest rate risk in the lease portfolio and to monitor and mitigate the interest rate risk associated with leases. Lessors utilize a variety of ALM techniques to easily and effectively manage interest-rate risk, such as adjusting the duration and payment frequency of leases by basing interest payments on floating rates and hedging exposures with interest-rate swaps.

| Swap Strategies | ||

|---|---|---|

| Position | Expectation | Swap Strategy |

| Fixed-Rate Debt | ↑ Rates go up | Do nothing |

| ↓ Rates go down | Pay floating, receive fixed | |

| Floating-Rate Debt | ↑ Rates go up | Pay fixed, receive floating |

| ↓ Rates go down | Do nothing | |

Leave A Comment

You must be logged in to post a comment.