- Inspect the leased asset;

- Review the financial statements and other information of the lessee and any guarantor on a periodic basis;

- Bill the lessee for and collect the amounts due under the lease agreement; and

- Enforce the lessor’s default rights and remedies with respect to the lease documents and leased asset in the event of lessee default.

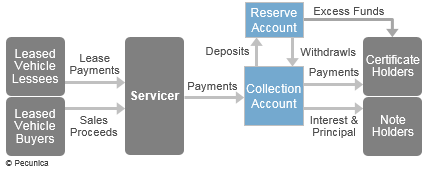

Where leases are securitized, the special purpose vehicle (SPV) typically enters into a servicing agreement with the lessor as servicer. The lessor remains responsible for the continued collection of interest and principal payments from the leases originated by the lessor (i.e., lease receivables) and for their remittance to the account maintained on behalf of the SPV. Because it controls the collection policy, the servicer can significantly affect the cash flows in a transaction. For asset securitization, a back-up servicer may be appointed to act as the servicer in the event of the original servicer’s failure to perform or insolvency in order to mitigate the risk of disruption in the servicing of the underlying assets.

| The Servicer in a Lease Titling Trust Structure |

Source:

|

Leave A Comment

You must be logged in to post a comment.