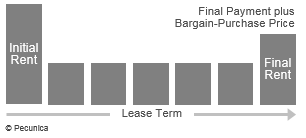

A bargain purchase option (BPO) is the contractual right of a lessee to purchase the leased asset at a fixed price that is substantially below its expected fair value when the option becomes exercisable at the end of the basic lease term, with the option so priced to ensure its exercise. A bargain purchase option is capitalized by both the lessor and lessee, it increasing the present value of the minimum lease payments by its present value and is equal to the difference in the value of the leased asset and the lease obligation recorded by the lessee (Leased Asset - Lease Obligation).

Once the final lease payment is made, the lease obligation balance will equal the value of the BPO. Because the lessee will acquire and account for the equipment over its life, depreciation is calculated over the asset’s economic instead of the lease term.

| Payments on Lease with a BPO |

Source:

|

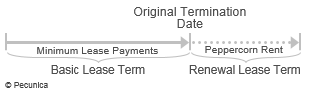

The lessee’s contractual right to extend a finance lease beyond its basic lease term for rental payments substantially below the asset’s expected fair rental is a bargain renewal option (BRO), with the option so priced that its exercise is reasonably certain. The option may provide for the lease’s renewal for a fixed secondary term on a year-by-year basis or indefinitely until the lessee gives notice. Where a finance lease cannot have a bargain purchase option, a lease can include a bargain renewal option and qualify as a true lease for tax purposes.

| Basic and Renewal Lease Terms |

Source:

|

Leave A Comment

You must be logged in to post a comment.