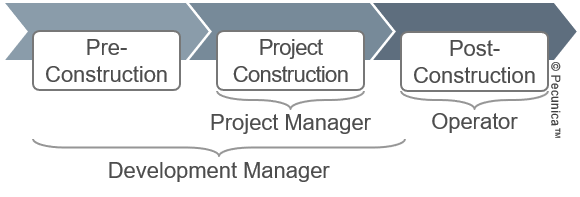

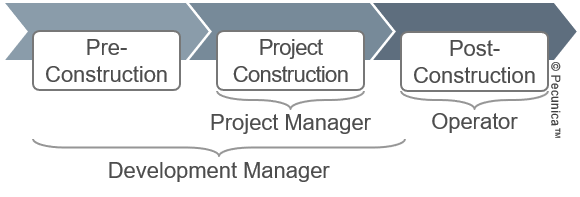

A commercial property development project calls for the property developer to engage numerous professionals and service providers in various capacities during a project's extended life cycle. Many of the same parties participate in the project's planning, construction and operational phases.

A vertically integrated developer normally has a staff of professionals required to deliver projects, calling for a minimum of external consultants and contractors. An affiliate in the company group commonly acts as the development manager, project manager, general contractor, facility manager, and asset manager.

The development manager is the developer's agent with responsibility for overall development management and coordination of the project participants. Acting as the overall risk manager, the development manager is also responsible for the control of project risks.

To define, test and justify the project business case, a feasibility analyst and tax advisor are generally engaged. When build-to-suit, the intended operator collaborates in the planning process with the designer team.

For construction planning, architects, engineers, a commercial construction cost estimator, an environmental consultant, a procurement and materials manager, and a commissioning agent are commonly involved. For actual project construction, a general contractor and subcontractors are engaged.

The project manager maintains the progress of the property's construction and interaction of the project team, controls construction costs and reduces the risk of project failure. An integrated developer also responsible for project management.

For the financing of the project, commercial real estate lenders – construction lender, interim lender, permanent lender and/or mortgage lender – are involved. The contribution of the equity investors is also commonly required for a project's financing.

For land acquisition, project exit and property disposition, a real estate appraiser/property valuer, real estate attorney, title company, and a real estate broker are usually required. REITs, private equity funds, investment funds, and institutional investors are the principal investors in commercial real estate.

Property operation may involve a independent operator or brand management company, a facility manager and a lease administrator. The asset manager is engaged post-construction to realize full operational efficiencies.