IFRS 9 Financial Instruments prescribes the classification and measurement, impairment and hedge accounting of financial instruments. It was published 24 July 2014 and will become effective as of 1 January 2018.

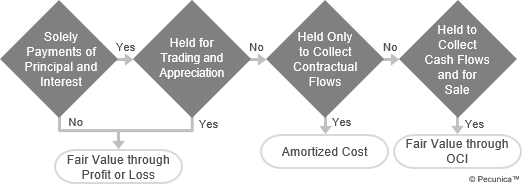

The business model test requires an entity to determine whether its business model for financial assets is to either (a) hold the instruments with the intention to collect the contractual cash flows over their life or (b) sell the instruments to realize a profit or loss. The test is applied to asset portfolios at an entity wide level – not on individual assets – and is based on fact – not management intent. However, entities can have more than one business model, such as commercial banking, retail banking and securities trading.

| IFRS Business Model Test for Debt Instruments |

Source:

|

If more than an infrequent number of sales are made out of a portfolio, the entity should assess whether and how the sales are consistent with the hold-to-collect objective. Where the objective for managing the debt investments is either to realize cash flows through sale or to evaluate its performance on a fair value basis, then it is not consistent with the hold-to-collect business model

The IFRS contractual cash flow characteristics test is the assessment performed at an individual instrument level to determine whether the contractual terms of a financial asset result in cash flows that are solely payments of principal and interest. The SPPI criterion is met if the contractual terms of the financial asset only give rise to cash flows that are solely payments of principal and interest on the principal amount outstanding on specified dates. Amortized cost and FVOCI apply only to portfolios of instruments that meet the SPPI criterion.

| Financial Asset at Amortized Cost (Example) | ||||

| Par value: €5,000,000 Effective interest rate: 5% Payable: 31 December annually Remaining maturity: 4 years Market rate on 31 December 16: 6% | ||||

| Date | ECF ($m) | 5% DF | PVECF ($m) | |

| 31 Dec 16 | 0.25 | 0.9524 | 0.2267 | |

| 31 Dec 17 | 0.25 | 0.9070 | 0.1814 | |

| 31 Dec 18 | 0.25 | 0.8638 | 0.2160 | |

| 31 Dec 19 | 0.25 + 5 | 0.8227 | 4.3192 | |

| 5.0000 | ||||

A financial asset is classified as subsequently measured at amortized cost under IFRS 9 if it meets both of the hold-to-collect business model test and the SPPI contractual cash flow characteristics test. Examples of financial instruments that are classified and accounted for at amortized cost under IFRS 9 include trade receivables, loan receivables with “basic” features, government bonds not held for trading, and term deposits at standard interest rates.

The IFRS fair value through other comprehensive income (FVTOCI) classification applies to debt instruments (a) whose contractual cash flows are solely payments of principal and interest (SPPI) and (b) whose business model is both collecting contractual cash flows and selling financial assets, unless designated at FVTPL under the fair value option upon initial recognition.

Under IFRS 9, financial assets are classified at fair value through profit or loss (FVTPL) that are held for trading purposes, including any debt asset that is that are not held in a hold-to-collect business model; equity investments that are not measured at FVTOCI, not accounted for under the equity method, or that do not result in consolidation; and any derivatives not designated as a hedging instrument. FVTPL is the IFRS default classification for financial assets.

| Financial Asset at Fair Value (Example) | ||||

| Par value: €5,000,000 Coupon: 5% Payable: 31 December annually Remaining maturity: 4 years Market rate on 31 December 16: 6% | ||||

| Date | ECF ($m) | 6% DF | PVECF ($m) | |

| 31 Dec 16 | 0.25 | 0.9434 | 0.2358 | |

| 31 Dec 17 | 0.25 | 0.8900 | 0.2225 | |

| 31 Dec 18 | 0.25 | 0.8396 | 0.2099 | |

| 31 Dec 19 | 0.25 + 5 | 0.7921 | 4.1585 | |

| 4.8267 | ||||

Leave A Comment

You must be logged in to post a comment.