US mutual funds are not subject to US federal income tax at the fund level if they satisfy certain tax requirements and distribute all their income to shareholders. Generally, the taxation of distributions at the investor level depends on the amount and the nature, source and type of income earned on the underlying fund assets, the holding period of any portfolio assets sold, and the gain or loss recognized on the sale of those assets.

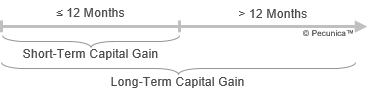

A fund realizes a capital gain when it sells a portfolio investment that has appreciated above the asset’s net purchase price. If a capital gain is realized on an investment that has been held for over one year, it is a long-term capital gain (LTCG) and generally taxed at the fund level. If a fund realizes short-term capital gains (STCGs) from the sale of investments held for one year or less, they are treated as ordinary cash dividends and passed on to fund investors without taxation. At the end of the year, most investment companies are required to distribute to current shareholders any net capital gains it has realized on the sale of portfolio securities. Also, a capital gain is realized by a fund investor when fund shares are redeemed or sold above their purchase price, commonly when the shares are bought at a discount or sold at a premium to NAV.

| Short-Term and Long-Term Capital Gains |

Source:

|

ETFs generally minimize the realization – and taxation – of capital gains by making in-kind exchanges to redeem ETF shares, which does not involve the sale of securities by the ETF or trigger capital gains for tax purposes. An in-kind exchange is the redemption of EFT shares with the ETF sponsor bought by an authorized participant (AP) in the secondary market in exchange for the underlying securities of equal value, which does not trigger a potential capital gain for the EFT.

Like cash dividends, net capital gains can be paid out to investors in cash or reinvested in the fund, at the investor’s option. Mutual fund investors generally have to pay taxes on any capital gains they receive and are held liable for any capital gain reinvested in the fund.

| Fund Distributions (Example) | |||||

| Dividend History | Capital Gains History | ||||

| Date | Per Share Amount | Reinvestment Price | Date | Per Share Amount | Reinvestment Price |

| 6/22/17 | $0.08 | $31.47 | 11/29/16 | $5.5873 | $28.27 |

| 3/23/17 | $0.07 | $30.42 | 11/23/15 | $4.3392 | $32.34 |

| 12/23/16 | $0.08 | $29.22 | 11/24/14 | $6.4205 | $36.94 |

| 9/22/16 | $0.10 | $33.40 | 11/25/13 | $3.4873 | $38.29 |

Leave A Comment

You must be logged in to post a comment.