Except for real estate leasing, leases are classified by the lessors on the basis of an assessment of the characteristics of the arrangement at the inception or modification of the lease. This classification determines their initial and subsequent accounting.

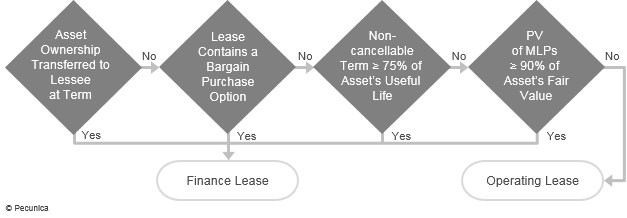

To be classified as a “finance lease” (IAS 17) or “capital lease” (ASC 840), the arrangement between the lessor and lessee must meet any one of the following criteria:

- Ownership of the leased asset is transferred by the lessor to the lessee by the end of the lease term;

- The lessee has a bargain-purchase option to buy the leased asset from the lessor at a price below its fair value;

- The lease term is greater than or equal to the “major part” (IAS 17) of estimated economic life of the leased asset or 75% (ASC 840); or

- The present value of minimum lease payments (MLPs) is equal to “substantially all” (IAS 17) or at least 90% (ASC 840) of the fair value of the leased asset.

| US Basic GAAP Lease Classification Decision Tree |

Source:

|

Moreover, the lessor recognizes the transaction as a capital lease under US GAAP only if:

- Collectability of the MLPs is reasonably predictable; and

- No uncertainties exist about additional costs to be incurred by the lessor.

US GAAP further classifies capital leases as either a sales-type lease or a direct-financing lease.

Any lease that fails to meet the criteria for classification as a finance or capital lease is recognized by the lessor as an operating lease.

The classification by lessors of such transactions as leveraged leases, real estate sale-leasebacks, real estate sales-type leases, and leases of land also differs under IFRS and US GAAP.

Leave A Comment

You must be logged in to post a comment.