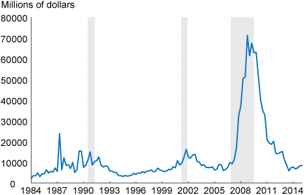

| Provisions for Loan and Lease Losses* 1984-2014 |

Source:

|

| * All FDIC-Insured Institutions Source: Cleveland Fed |

Under both US GAAP and IFRS, a leased asset’s impairment loss is credited by the lessor directly to the asset; if a revaluation account is used under IFRS, it is recognized in other comprehensive income (OCI). Under US GAAP, any recovery of an impairment is recognized as a gain in earnings. Under IFRS, if impairment is recovered, the impairment is reversed in the asset’s revaluation account, but not in excess of the original carrying amount net of depreciation – if the impairment loss exceeds the revaluation surplus, the remaining loss is recognized as expense in the income statement.

| Lessor Increase in Allowance for Loan and Lease Losses (ALLL) | ||||

|---|---|---|---|---|

| Date | Provision for Loan and Lease Losses | xxxx | ||

| Allowance for Loan and Lease Losses | xxxx | |||

| To record an increase in uncollectible loans and leases | ||||

Leave A Comment

You must be logged in to post a comment.