A corporate bond is any secured or unsecured, interest‑bearing or discount capital market debt instrument issued by a corporation, regardless of its maturity, as opposed to a bond issued by a central or local government entity or agency. US dollar and euro-denominated bonds are generally issued with a par value of $1,000 and €1,000, respectively. They are issued as short-term notes, medium-term notes and long-term bonds. The corporate bond market is highly fragmented in terms of type of issuer and bond.

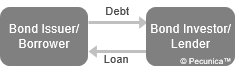

| Bond Issuer-Investor Relationship |

Source:

|

When a corporate bond is offered to the public in US markets, it must be issued under an indenture. An indenture is a contract between the issuer of a corporate or municipal revenue bond and the bondholders, specifying the issue’s terms and conditions, including the bond’s form, the issue amount, the par value, interest rate, maturity date, covenants, any embedded options, and, if secured, the collateral. A bond trustee acts as agent for all holders of a bond, representing the interests of the bond investors in all legal matters and having the responsibility of ensuring the issuer’s fulfillment of the bond indenture’s terms and conditions.

Corporate bonds are generally registered securities that require registration with the local financial market authorities where they trade, such as the Securities and Exchange Commission (SEC) for the US market and the UK Financial Conduct Authority (FCA) for bonds trading in the UK. An exempt security is any security that need not be registered with the financial market authorities where the security trades, including US Treasury securities, state- and local-government issues, domestic bank issues and corporate issues with a maturity of 270 days or less traded in the US.

Leave A Comment

You must be logged in to post a comment.