A distinct business unit or other organization for which accounting records are kept and financial statements are prepared is an accounting entity. The business-entity assumption considers the personal assets of a firm’s owners to be separate and distinct from the business entity’s assets, it applying to all legal forms of business (i.e., sole proprietorships, partnerships and corporations).

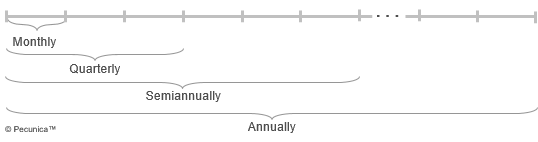

The periodicity assumption identifies economic activity with time periods and the activity of each time period is measured and recognized in the corresponding period. The period of time during which financial transactions and events have occurred, are recognized and for which financial statements are prepared is an accounting period, most commonly monthly, quarterly and annually.

| Accounting Periods |

Source:

|

The going-concern assumption expects accounting entities, under all ordinary circumstances, to continue existing indefinitely in the future. It is central to the historical cost convention in financial reporting, among other things, and is essential for the preparation of financial statements. Since it is assumed that a company has unlimited life, assets are valued at their historical cost rather than liquidation value.

A business’s going-concern value is the liquidation value of its assets plus any amount by which the assets’ reported value (i.e., book value) exceeds their liquidation value. The going-concern concept is one of the basic assumptions underlying generally accepted accounting principles. The going-concern assumption, however, is of no significance for entities that have entered bankruptcy proceedings.

Leave A Comment

You must be logged in to post a comment.