The cash flow statement shows the results of transactions in three categories that are sources and uses of cash:

- Operating cash flow – Net cash provided by and used for operating activities, which involves current assets and liabilities excluding long-term debt;

- Investing cash flow – Net cash provided by and used for investing activities, which involves noncurrent assets; and

- Financing cash flow – Net cash provided by and used for financing activities, which involves short- and long-term funded debt and equity.

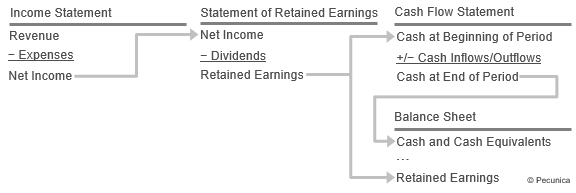

| Cash Flow through the Financal Statements |

Source:

|

The statement of cash flows uses the cash flow figures from each of these categories to link the cash balance reported in the balance sheet at the beginning of the period to the cash balance reported at the end of the period. The statement allows users to assess the ability of the firm to generate cash and cash equivalents, the timing and certainty of their generation, and how those cash flows are used.

Significant noncash investing and financing activities must be reported gross (e.g., the purchase and sale of equipment) and shown separately in the cash flow statement or in a footnote to the financial statements. They must be reported either directly, using major categories of gross cash receipts and payments, or indirectly by providing a reconciliation of net cash flow from operating activities.

Leave A Comment

You must be logged in to post a comment.