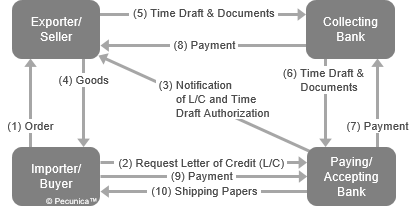

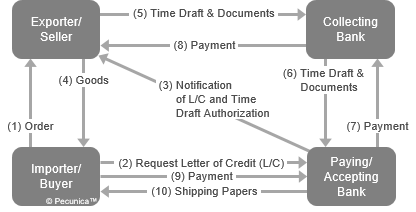

A banker’s acceptance (BA) is a negotiable short-term high quality straight discount money market instrument in the form of a time draft authorized under a letter of credit drawn on a bank by its client “in respect of current trade” and backed by an accepting bank’s unconditional promise (“acceptance”) to pay the draft’s face value to a beneficiary at maturity. Acceptances are usually arranged to cover the time required to ship and dispose of the goods being financed. They are usually created in amounts in excess of $100,000.

Upon acceptance, which occurs when the draft is stamped “accepted” and signed by the bank, the draft becomes an unconditional liability of that bank. The accepting bank may hold the acceptance and collect the draft’s face value at maturity or rediscount (sell) it in the secondary market, giving the buyer an amount less than the draft’s face value. The buyer then uses the proceeds to pay the seller for the merchandize.

| Creation and Flows of a Banker’s Acceptance |

Source:

|

An acceptance qualifies as a money market instrument based on the credit standing of the accepting bank, whereby the better the quality, the “finer” (lower) the rate. BAs are recognized as one of the lowest credit risks in the money market because they are backed in three ways and, thus, also called “three-ways-out paper”:

- The letter of credit, which substitutes the bank’s credit for the client’s;

- The guarantee of the accepting bank, which becomes the primary obligor; and

- The goods that are the subject of the financing and object of the transaction.

Leave A Comment

You must be logged in to post a comment.