| Collateral Assignment of a Lease |

Source:

|

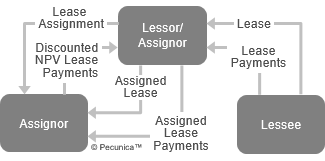

Rather than obtain funding of leases at lease origination, lessors often assign the lease payments and the leased assets to finance the leases after lease inception. By back-leveraging, a lease funder makes a nonrecourse loan to the lease originator after inception of the lease that is secured by the collateral assignment of the leased asset to the funder and the lease payments as the means to service the debt. As a collateral assignment, the lessor incurs a direct obligation to the lease funder for the loan while remaining the owner of the leased asset. Since a collateral assignment usually requires lessee consent, lessors obtain the right to back-leverage leases at lease origination.

Back-Leveraging = Collateral Assignment after Lease Inception

Although the lessor retains ownership of the leased asset, a collaterally-assigned lease must be managed with the consent and approval of the assignees. Moreover, a collateral assignment generally allows funders to share in and exercise rights of the lessor under the lease in their own name, which makes it necessary for the lessor to negotiate shared rights with the funders. Shared rights, which are the rights of the lessor – as assignor – and the assignee that each exercises in its own name, typically include the right to receive notices and other documents from the lessee, to inspect the property interest, to enforce lessee compliance with certain covenants, to call upon the lessee for the payment of indemnities, and to seek recovery under the lessee’s liability insurance coverage. Once the funding is repaid in full, the funder relinquishes the collateral assignment and the lessor again has full control over the asset.

In addition to shared rights and the terms of lessee consent, lease assignment provisions normally stipulate the level of assistance a lessee is to provide to a lessor, such as indemnification and insurance. Moreover, the lease agreement will typically also contain a provision expressly providing to lessees the right to quiet enjoyment, which is the right of tenants and landlords to the continued undisturbed use and enjoyment of real property to be honored by the assignee should the real estate be collaterally-assigned.

Leave A Comment

You must be logged in to post a comment.