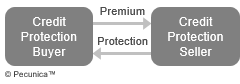

A credit default swap (CDS) is an over-the-counter bilateral contract of a notional amount and specified term in which the seller receives a series of periodic premium payments from the buyer (investor) and the buyer pays the seller the contract amount upon the occurrence of a specified a credit event of the reference entity. A credit default swap is essentially an insurance contract on a firm’s debt. They are used both to hedge and to speculate on credit risk. A CDS has a maturity date normally of three, five, seven or ten years, with the maturity of five years being the most common. A CDS involves three parties:

- Protection buyer – The CDS counterparty that hedges the credit risk in underlying assets.

- Protection seller – The counterparty that assumes the credit risk in a CDS from the protection buyer in exchange for regular premium payments.

- Reference entity – The third-party bank, nonbank Commercial or government entity with outstanding public debt whose specified obligations are referred to and whose default triggers a payout in the CDS.

| Purchase of a Credit Default Swap |

Source:

|

The notional defines the level of exposure under the contract. The notionalprincipal is the contractual amount of protection provided in a credit default swap and used to compute the periodic premium payments to the protection seller, it being the protection seller’s maximum possible exposure in the event of default by the reference entity, with settlement of the CDS being based on the recovery value of debt with this value.

The credit default swap spread periodic payments, usually quarterly, a protection buyer makes to a protection seller, expressed as a percentage of the notional principal. It reflects how risky the market perceives an entity to be. The CDS market comprises a relatively small number of sophisticated investors. CDS spreads are regarded as the best measure of current and short term outlook of unexpected events. The lower the credit rating of the reference entities and the longer the maturity of the contract, the higher the credit spread will be.

| CDS Spreads by Select Bank (1 Year) | ||||

| Mean | Std | Min | Max | |

| Barclays | 69.95 | 60.97 | 1.77 | 272.08 |

| Bear Stearns | 143.61 | 194.49 | 5.96 | 1367.72 |

| Deutsche Bank | 55.77 | 43.14 | 2.26 | 184.36 |

| JP Morgan | 57.84 | 48.33 | 3.19 | 251.12 |

| Lehman Brothers | 206.93 | 245.09 | 5.89 | 1422.78 |

| Morgan Stanley | 234.21 | 335.03 | 6.22 | 3110.48 |

| Source: Sul, Hong Kee | ||||

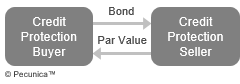

A credit event is an event whose occurrence during the life of a credit default swap gives the protection buyer the right to settle the contract, the three most common being the failure of payment default, bankruptcy or restructuring of the reference entity. If a credit event occurs in the reference entity during the life of the contract, then it is either cash or physically settled:

- Cash settlement – The credit-default amount is paid by the protection seller to the protection buyer equal to the difference in the market value of the specified reference security and its par value;

- Physical settlement – The protection buyer delivers a defaulted asset (usually bonds) to the protection seller at par instead of redeeming with cash, which is the market standard.

While CDSs transfer the credit risk of one single reference entity, CDOs transfer the credit risk of a portfolio of reference entities. Furthermore, a CDS references a third-party bank, nonbank Commercial or government entity with outstanding public debt, whereas a CDO can be used to transfer the credit risk of borrowers that do not have outstanding public debt or trade in the CDS market. Along with CDOs, CDSs are the primary means of transferring credit risk from a loan portfolio to third-party investors without jeopardizing customer relationships.

| Physical Settlement of a CDS |

Source:

|

Leave A Comment

You must be logged in to post a comment.