| Top 5 Real Estate Leasing and Investment Brokers 2014 | ||

|---|---|---|

| Rank | Company | Total Value* (mn) |

| 1 | CBRE Group | $284,900.0 |

| 2 | JLL | $189,700.0 |

| 3 | Newmark Grubb Knight Frank | $102,670.6 |

| 4 | Cushman & Wakefield | $100,799.6 |

| 5 | Colliers International | $97,100.0 |

| * The total dollar value of leasing transactions and investment sales in the United States and globally in 2014. | ||

| Source: National Real Estate Investor | ||

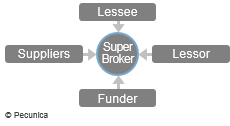

A super broker is usually a very experienced lease broker that as a broker’s broker coordinates lease transactions between other lease brokers and leasing companies and advises on closing the transactions. They locate prospective lessors to whom they submit lease and credit applications, using their own documentation, without conducting credit investigations.

| Super Broker Relationships |

Source:

|

A packager is a lease broker that is specialized in structuring and negotiating the whole transaction, generally big-ticket leasing, on behalf of the other parties, for a commission, typically using and signing the lease documents in its own name (i.e., private labeling). The range of services provided by a packager commonly include finding the lessee, locating the lessor, obtaining the lease and credit applications, conducting the credit investigations, submitting a full documentation package to the prospective lessor, working with the equipment manufacturer and securing debt and possibly equity financing required by the lessor to finance the purchase of the equipment. Lease packagers commonly retain the option to purchase the equipment.

Leave A Comment

You must be logged in to post a comment.