Underwriting is the structured process used by lenders, landlords and investors to assess the transaction needs and the risks of a potential transaction in order to determine whether it will assure and arrange the transaction and the price – cost to the customer – for assuming the risks of the transaction. The process by which a finance lease is assured, arranged and provided by a lessor to a lessee is lease underwriting, whereby the underwriter assumes the risk of the lease’s funding and credit risk.

The definitions, calculations, documentation, guidelines, standards, policies and other requirements used to determine whether a lease transaction meets eligibility criteria are underwriting requirements. Before underwriting a lease, the lessor assesses the probability of realizing the targeted return on its investment in the form of rental payments, the asset’s residual value and tax benefits. Credit review is key to the lease underwriting process.

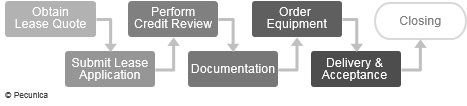

| The Lease Underwriting Process |

Source:

|

Some underwriting lessors require lease documentation only on their paper, whereas some vendors prefer to use documentation that identifies them as the lessor. In private labeling, a lease underwriter’s documentation is used while the lease originator is named as the lessor. When private label documentation is used, the lease is typically assigned to the underwriter under a discounting arrangement, either with or without recourse to the lease originator, depending on the particular arrangement between the lease originator and the funding source.

Leave A Comment

You must be logged in to post a comment.