A leveraged lease is a noncancellable long-term big-ticket finance lease that relies on long-term debt provided to the lessor for the leased asset’s refinancing, it involving the lessee, the lessor, long-term lenders, the asset’s supplier, an indenture trustee and, often, an owner trustee. They are so structured to allow the lessee to utilize the lessor’s capital invested in a leased asset that is substantially leveraged by institutional debt. Such leases commonly have terms of 25 or more years and must be sufficiently large to justify the significant cost and complexity in arranging, documenting and managing the arrangement. Leveraged leases are used by many corporations to finance real estate and big-ticket capital equipment.

Lessees use leveraged leases for the long-term asset-based financing of commercial real estate and high-priced equipment at a lower cost than alternative methods of financing as well as for their off-balance sheet treatment as an operating lease – it is not shown on the lessee’s books as an obligation. Lessors use leveraged leases to obtain the necessary funding of big-ticket assets and to take advantage of the tax benefits of asset ownership. Debt participants use leveraged leases as an opportunity to invest large sums of debt capital on a fully secured basis, although without recourse to the lessor.

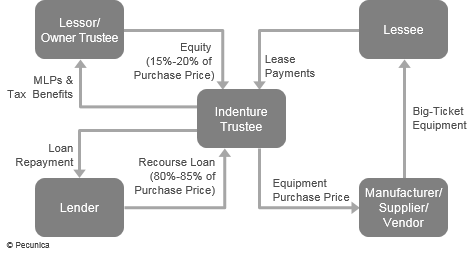

| Parties and Flows in a Leveraged Lease |

Source:

|

Leave A Comment

You must be logged in to post a comment.