A money market fund (MMF) comprises a portfolio of high-quality, short-term securities, such as treasury bills and commercial paper, and that pays dividends that normally reflect short-term interest rates. They are managed with the objective of maintaining a highly stable asset value through liquid investments, while paying interest income to investors.

As with bond funds, US money market funds are classified by their principal underlying assets:

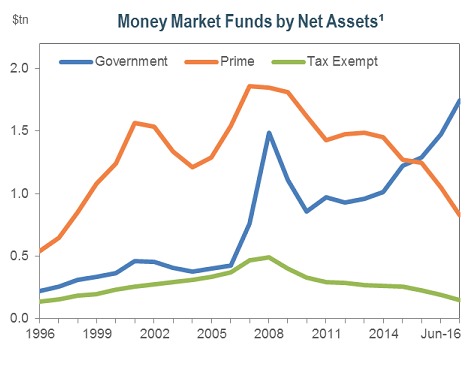

- Government money market fund – 99.5% or more of its total assets in cash, government securities, and/or repurchase agreements that are fully collateralized by government securities or cash.

- Tax-exempt money market fund – Comprised of the short-term debt securities of state and local jurisdictions (municipal notes), which are usually exempt from US federal income tax and the income tax of the state of issue.

- Prime money market fund – Mainly high-quality commercial paper, certificates of deposit and short-term government, agency and municipal securities.

| Impact of SEC Regulation Change on MMFs in 2016 |

Source:

|

Money market funds are also characterized by the nature of investor they are targeted to:

- Retail money market fund – Offered primarily to retail investors, with policies and procedures designed in the interest of such investors; and

- Institutional money market fund – Requiring a high minimum investment and marketed to corporations, governments and financial fiduciaries, commonly set up to automatically pool idle cash from the main operating accounts of the institutional investors and to transfer (“sweep”) the cash to the fund overnight.

Money market funds seek to limit losses due to credit, market and liquidity risks. They are commonly used to provide liquidity and for principal preservation.