The right of an assignee or buyer in a financial transaction to demand performance from the transaction assignor or seller in the event of default on the underlying debt is recourse. Where a financial transaction is nonrecourse, its assignor or seller is not held liable for payment and performance in the event of default on the underlying debt.

Assignments may be with recourse, without recourse or with limited recourse of the assignees (funders) to the loan originator the event of borrower default on the assigned loans:

- Recourse assignment – The assignor is held liable to provide the assignee payment and performance of the underlying debt or to repurchase the assigned rights from the assignee upon occurrence of an event of default under the transaction;

- Limited recourse assignment – The assignor is liable to the assignee only for a portion of the remaining obligations of the underlying debt upon occurrence of an event of default under the loan, where the recourse amount normally decreases and eventually ceases after a certain period of time;

- Nonrecourse assignment – The assignor bears no liability toward the assignee for payment and performance of the underlying debt in the event of default on the transaction, where most assignments provide the assignees no recourse to the assignor.

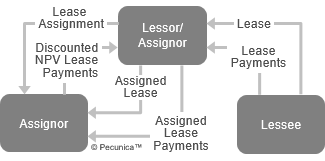

| Collateral Assignment of a Lease |

Source:

|

Leave A Comment

You must be logged in to post a comment.