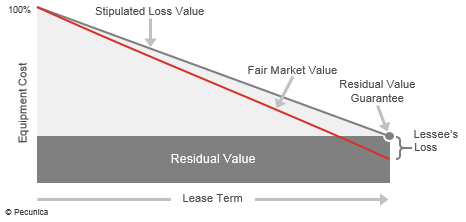

At the end of the lease term, a leased asset is equal to the residual value. Residual value can be either unguaranteed or guaranteed by the lessee or a party related to the lessee. By means of a residual value guarantee, the lessee is held liable for any difference between a leased asset’s residual value and a lower salvage value realized by a lessor at the end of the lease. A residual value guarantee is included at lease inception in the calculation of the minimum lease payments and is paid at the end of the lease term.

The guaranteed residual value (GRV) is the residual value of a leased asset that is guaranteed by the lessee or by a financially capable third party not related to the lessor and included in the minimum lease payments to be made by the lessee. Unlike unguaranteed residual value, guaranteed residual value is included in the calculation of MLPs and treated as an additional lease payment to be made at the end of the lease term.

That portion of a leased asset’s residual value whose realization by the lessor is not guaranteed or that is guaranteed solely by a party affiliated with the lessor is unguaranteed residual value (URV). While it has no effect on the MLPs or capitalization of the leased asset and obligation for the lessee, unguaranteed residual increases the lessor's gross investment in the lease.

Unguaranteed Residual Value = Residual Value - Guaranteed Residual Value

The stipulated loss value (SLV) is the amount the lessee is held liable for in the event the leased equipment is lost or irreparably damaged during the lease term as established in the stipulated loss value schedule equal to the present value of remaining lease payments and the residual value at any point in time. The stipulated loss value schedule in an equipment lease agreement states the value of the lease at various points in time during the lease term plus its residual value and associated tax benefits and is intended to compensate the lessor for its anticipated total return on the lease.

The SLV and the value of an early-buyout option are effectively the same since they both should equal the present value of remaining lease payments and the residual value at any point in time, adjusted for tax effects. SLVs are often significantly higher than the theoretical value of the leases to provide lessors profit on the asset’s disposition.

| Lease Stipulated Loss Value |

Source:

|

Leave A Comment

You must be logged in to post a comment.