A lease transaction that involve the sale of an asset and the leasing back of the same asset either before or after the asset is put into use is a sale-leaseback. An equipment sale-leaseback is a transaction in which the owner of equipment that has significant remaining economic life sells the asset under the agreement to simultaneously lease it back from the buyer/lessor on a long-term basis; they typically involve middle- and big-ticket assets. A real estate sale-leaseback is a transaction in which a firm sells its commercial real estate to another party, such as an institutional investor or a real estate investment trust (REIT), and then leases the property back from the new landlord.

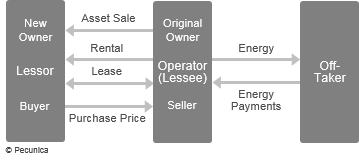

| Sale-Leaseback in an Energy Project Financing |

Source:

|

Lessees arrange equipment and real estate sale-leasebacks for such reasons as:

- Increase in their working capital and liquidity through the conversion of the noncurrent fixed asset into cash;

- Generation of a gain for the lessee where the asset’s fair market value exceeds its book value;

- Reduction of the cost of financing by refinancing the asset at a lower implicit interest rate; and

- Refinancing of the asset longer term when the original asset purchase was financed with short-term funds.

The lease term and conditions of sale-leaseback transactions are based on the nature and quality of the asset, the lessee’s credit rating and the lessor’s financing costs and the required rate of return on the investment (ROI).

Leave A Comment

You must be logged in to post a comment.