Stock funds invest chiefly in the stock (equity) of different publicly traded companies, generally with the objective of long-term growth through capital gains. They are actively or passively managed and focus on a certain sector of the market, on companies of a certain size, and on value and growth factors.

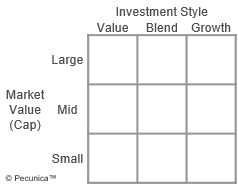

| A Style Box for Stock Funds |

Source:

|

Stock funds are normally classified according to their investment focus:

- Index fund – A portfolio of securities constructed to track the components of a market index and achieve returns that closely correspond to the reference index, such as the S&P 500 or DAX 30.

- Value fund – Value stock of companies that trade at discounts to book value, regarded as subpar by the market, have high dividend yields, low price-to-earnings ratios, or low price-to-book ratios.

- Income fund – Companies with long histories of dividend payments, such as utilities and blue-chips stocks, with a focus on current income over growth.

- Balanced fund – Stocks for capital appreciation, bonds for income and money market instruments or cash for liquidity, with the goal of realizing long-term capital gains and generating regular income while reducing risk through diversification among investment categories.

- Growth fund – Stock of companies that demonstrate rapid growth and are expected to outperform the overall market over time, focused on generating capital gains rather than income.

- Sector fund – A single area of industry, commonly with a minimum of 25% of its assets invested in the sector, such as technology or healthcare funds, it providing a way for investors to participate in a given segment of the economy without having to identify specific companies.

An index fund is passively managed. Value, income, balanced and growth funds are actively managed in accordance with the fund's respective investment objective. A sector fund, which focuses on a certain sector of the market, may be actively or passively managed.

A stock fund’s returns may result entirely from capital return, although dividends are also an important source of total return. They produce different patterns of returns than individual stocks primarily because they hold diversified portfolios of stocks.