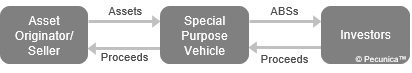

By means of ABCP, securitization is applied to short-term corporate funding. Asset-backed commercial paper (ABCP) is commercial paper (CP) that is issued by a bankruptcy-remote special purpose vehicle (SPV) and whose interest and principal payments are derived from the cash flows from a pool of medium- to long-term financial assets of one or more asset originators, commonly consumer and trade receivables, with the SPV using the proceeds from the sale of the securities to pay for the underlying assets it purchased. US ABCP of an “eligible conduit” has a maturity of no more than 397 days, while European ABCP (EABCP) is issued with a maturity of up to 364 days. ABCP may be either coupon-bearing or discounted.

| True Sale of Assets in an ABCP Program |

Source:

|

An asset-backed commercial paper program (ABCP program) is an arrangement under which a special purpose vehicle (SPV) is established to acquire and hold medium- to long-term financial assets, such as trade receivables, from one or more originator-sellers, with the purchase of the underlying assets being financed through the sale of ABCP by the SPV (conduit) to investors. ABCP programs are used to acquire and finance undivided interests in revolving pools of such financial assets as consumer and trade receivables, auto and equipment loans/leases, ABSs, MBSs, and corporate and government bonds.

The assets in an ABCP program must meet the sponsor’s minimum credit quality standards, based on the normal credit approval process. Sponsors also provide a liquidity line for each transaction, in order to:

- Address timing mismatches between the payment streams of the assets and the maturity dates of the CP; or

- Repay investors in the event the ABCP conduit cannot refinance maturing CP.

Leave A Comment

You must be logged in to post a comment.