An ABCP conduit is the bankruptcy remote special purpose vehicle (SPV) that is set up and operated by the program’s sponsor to purchase the receivables and other financial assets (e.g., rated securities) of its clients with the proceeds of the ABCP it issues. The assets of a conduit can comprise consumer assets, such as auto loans and leases, credit cards, student loans or residential mortgages, or commercial assets, such as trade receivables and equipment loans and leases.

ABCP conduits are established by financial institutions and large nonbank corporations to provide financing alternatives to clients or to finance their own assets, respectively. Structured to be bankruptcy remote and legally separate from its sponsor, they are a means of off-balance sheet funding for the seller-originator and sponsor, allowing the sponsor to avoid capital requirements imposed on financial institutions. ABCP conduits are single-seller, multi-seller or securities-backed programs (securities-arbitrage conduit).

In a single-seller conduit, an ABCP program is set up by a single-asset originator, typically a nonbank sponsor, for the securitization of financial assets resulting solely for its own activities and generally of the same type. An asset originator might choose to establish and sponsor its own ABCP program in order to control ABCP issuance or to realize financing cost savings or accounting or tax advantages, instead of participating in a multi-seller conduit. The originator-sponsor provides credit enhancement to a single-seller conduit in the form of overcollateralization.

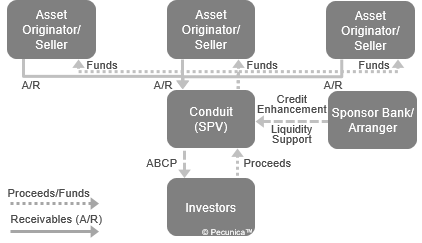

In a multi-seller conduit, an ABCP program is established by a financial institution as sponsor for numerous clients to fund the financial assets that the clients originate and sell to the ABCP conduit. Sponsors provide credit enhancement in the form of a letter of credit, subordinated interest or a purchase commitment, while each asset seller-originator provides credit enhancement in the form of overcollateralization (originator-level enhancement). One of the main attractions of multi-seller conduits is that they provide nonbank corporate originators of financial assets access to the CP market who would otherwise find it uneconomical to establish and operate their own program.

| Multiseller ABCP Structural Flows |

Source:

|

Leave A Comment

You must be logged in to post a comment.