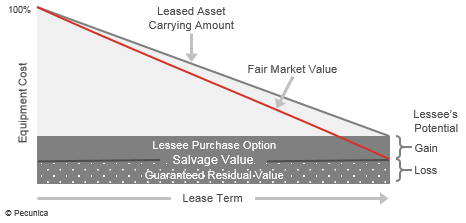

A closed-end lease does not contain a purchase or renewal option, it requiring the lessor to take possession of the asset at the end of the lease term, thereby exposing the lessor to any residual value risk. A lease in which the lessee guarantees the lessor the difference between the residual value of the leased asset and the value realized from the asset’s sale at lease termination is an open-end lease, it thus exposing the lessee to residual value risk. If the realized value is greater than the residual value, the lessee may receive the difference, subject to prior agreement.

Open-End Lease = Residual Value Guarantee = Lessee Residual Value Risk

Under US IRS tax guidelines, a TRAC lease is an open-end equipment lease with a contract provision that requires the lessee’s final rental payment on a leased motor vehicle or trailer to be adjusted either upward or downward by reference to the amount realized upon sale or other disposition of the asset compared to the residual value stipulated in the contract. Although treated as a true lease for tax purposes if it meets the tax guidelines, the lessor must accept sufficient risk through a residual sharing agreement to meet the 90% fair-value test for it to qualify as an operating lease for accounting purposes. TRAC leases play a significant role in US vendor leasing programs.

| TRAC Lease at Termination | |

|---|---|

| RV > Salvage Value | Lessor pays the difference to the lessee |

| RV < Salvage Value | Lessee pays the difference to the lessor |

A split TRAC is a modified TRAC lease where the lessor assumes part of the estimated residual value risk and limits the lessee’s end (residual risk) exposure, structured as a synthetic lease to allow lessees to classify the transaction as an operating lease. Under US tax rules, TRAC leases are available only for equipment leasing of licensable vehicles for highway use, primarily for automobiles and light-duty trucks.

| Split TRAC Lease |

Source:

|

Leave A Comment

You must be logged in to post a comment.