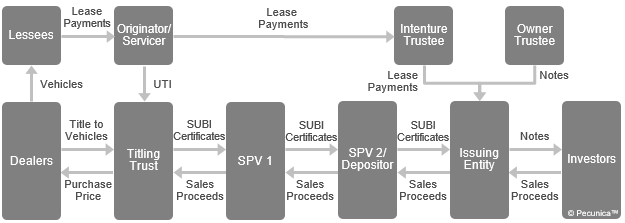

The beneficial interest in the vehicles and leases that have not yet been securitized is an undivided trust interest (UTI), which represents the right to receive all the proceeds of the assets of a titling trust that are not otherwise allocated to one or more special units of beneficial interest (SUBI) and pledged to commercial paper conduits to provide warehouse financing for the leases and vehicles. For the securitization of automotive leases, special units of beneficial interest (SUBI) are created and sold representing a beneficial interest in those vehicles and leases to be securitized – the remaining assets are still represented by the UTI.

The SUBI are transferred by the titling trust (the “origination trust”) to a bankruptcy-remote special purpose vehicle (SPV 1, “seller”) that is owned entirely by the sponsor. The SUBI are then transferred in a true sale (or a series of true sales) to another bankruptcy-remote SPV (SPV 2, “depositor”) in exchange for the ABSs that are then sold by an issuing entity (“issuer”) to investors in a public offering, with the sale proceeds of the ABS being used by the titling trust to purchase the SUBI certificates.

| Securitization of Automotive Leases |

Source:

|

Leave A Comment

You must be logged in to post a comment.