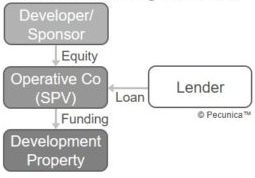

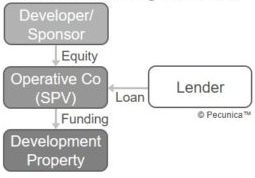

The structure of a real estate financing transaction generally depends on its purpose, the location of the borrower/sponsor, the lender’s loan portfolio, the security package, and tax considerations. Typically, a special purpose vehicle (SPV) is established in a suitable tax-efficient jurisdiction with clear and tested security and enforcement rules solely for the financing transaction.

Commercial real estate lending can be grouped by size and lender participation as either bilateral or multilateral and by type as acquisition, development and construction (ADC), bridge, or permanent financing. Each type of financing is utilized for different purposes during the different phases in the life cycle of commercial real estate.

Lending/investment parameters depend on the investment criteria and the degree of desired exposure to a client or sector. They include property's location, the transaction size, degree of leverage (senior, junior or mezzanine), asset type, and the lender’s investment horizon. Stricter capital requirements in recent years have had a significant impact on the lending capacity and risk appetite of banks as traditional commercial real estate lenders.

Multisector transactions, in which security is spread across different types of assets, tend to be the most common of all commercial real estate lending, followed by transactions secured by offices. Many lenders provide finance for any CRE sector – offices, shopping centers, mixed-use, retail, industrial, residential, and hotels, while some do not take exposure to certain sectors or asset classes (e.g., operational assets or development projects).