Credit risk management (CRM) involves the management of the overall credit risk of a financial institution consistent with its risk appetite, policies and business objectives. It should cover the entire credit cycle, from origination of credit to its extinguishment from the books. Optimizing the management of regulatory capital can be considered only in conjunction with credit risk management.

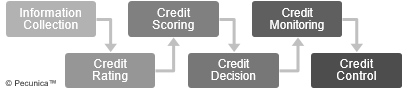

| Elements of the Credit Management Process |

Source:

|

Credit risk is the dominant source of risk for financial institutions (banks, leasing companies). The amount of capital in relation to risk weighted assets (capital-to-assets ratio) required by regulatory authorities that financial institutions must hold to ensure their ability to provide banking services to the public while meeting their short-term and long-term obligations and to absorb any losses that they may incur is capital adequacy (capital requirement, regulatory capital). Regulatory-mandated risk-based capital adequacy requires financial institutions to hold capital reserves to provide protection against the credit risk inherent in bank lending, the market risk activities banks undertake, and the operational risk of the institutions.

The capital adequacy requirements of financial institutions are set by the local financial regulator, such as the Bank of China for the Republic of China or the US Federal Reserve Board for the United States, generally based on the Basel Accords. The Basel Accords (Basel Capital Accords) are the series of recommendations on banking regulation – Basel I, Basel II and Basel III – issued by the Basel Committee on Banking Supervision (BCBS), housed at the Bank for International Settlements (BIS), to strengthen the regulation, supervision and risk management of the banking sector.

| Federal Reserve and Basel III Capital Requirements for Financial Institutions | |||||

| 1 Jan 2015 | 1 Jan 2016 | 1 Jan 2017 | 1 Jan 2018 | 1 Jan 2019 | |

| Capital Conversion Buffer | 0.625% | 1.25% | 1.875% | 2.5% | |

| Minimum Common Equity Tier 1 | 4.5% | 4.5% | 4.5% | 4.5% | 4.5% |

| Minimum Tier 1 Capital* | 6.0% | 6.0% | 6.0% | 6.0% | 6.0% |

| Minimum Total Capital† | 8.0% | 8.0% | 8.0% | 8.0% | 8.0% |

| * 4.5% Common Equity Tier 1 Capital + 1.5% Additional Tier 1 Capital † 6.0% Tier 1 Capital + 2.0% Tier 2 Capital | |||||

Leave A Comment

You must be logged in to post a comment.