- International Accounting Standards, originally issued before 2004;

- International Financial Reporting Standards, issued as of 2004;

- SIC Interpretations, issued before 2002;

- IFRIC Interpretations, issued as of 2004; and

- Other pronouncements.

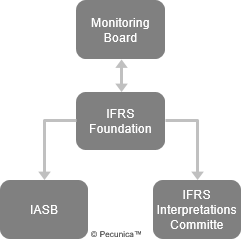

| IFRS Organization Structure |

Source:

|

The IASB system requires of reporting entities the following financial statements and information:

- A statement of financial position (balance sheet) at the end of the period.

- An income statement and other comprehensive income for the period;

- A statement of changes in equity for the period;

- A statement of cash flows for the period;

- Notes summarizing the reporting entity’s accounting policies and other explanatory notes; and

- A statement of financial position of at the beginning of the earliest comparative period when a firm retrospectively applies an accounting policy or restates or reclassifies items in its financial statements.

Titles for the statements other than those above may also be used.

Leave A Comment

You must be logged in to post a comment.