The early termination of finance leases, which is a form of options risk, could have a significant impact on the lessor. The risk of a lessor’s potential loss due to the early, unscheduled termination of a finance lease is lease termination risk. Termination risk can be minimized by appropriate lease provisions. Early termination provisions may be limited to only certain times and/or conditioned on timely advance notice, acceptable documentation and lessee acceptance of resultant costs or agreement to make up any deficit if the lessor is unable to recover its investment from remarketing the leased asset. When neither a leased asset’s salvage value nor insurance covers the lessor's outstanding gross investment (lease receivable) in a finance lease upon early termination, the unrecovered balance will have to be paid by the lessee.

Lease contracts can also prohibit lease prepayment – regardless of the circumstances. A hell-or-high-water provision obligates the lessee to make all contractual payments regardless of any difficulties that the lessee may encounter, any defects in the leased asset or any other performance issues with lessors, suppliers or manufacturers with respect to the asset, without regard to any defences it may have against the lessor. The provision usually forms part of a parent company guarantee and results in a very stable average-life of leases.

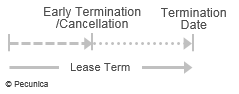

| Early Termination or Cancellation |

Source:

|

Leave A Comment

You must be logged in to post a comment.