- Market liquidity risk – The risk of adverse cost or returns an institution may incur due to its inability to unwind or offset positions without having to accept significantly unfavorable market prices;

- Funding liquidity risk – The risk that an institution can suffer either a loss or lower-than-expected returns due to its inability to obtain sufficient and suitable funding to meet its cash-flow requirements and obligations as they come due for payment.

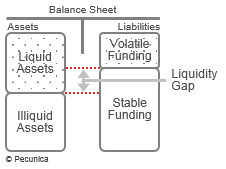

| Liquidity Gap |

Source:

|

Liquidity management is the process of forecasting funding requirements and the maintenance of sufficient liquidity to accommodate fluctuations in financial assets and liabilities while increasing the earning capacity of the lessor. Liquidity management involves a daily analysis and detailed estimation of the size and timing of cash inflows and outflows and balancing the trade-off between profitability and the risk of illiquidity. Leveraged leases, lease assignment, lease syndication and lease securitization are all techniques used by lessors to manage their market and funding liquidity risks.

Leave A Comment

You must be logged in to post a comment.