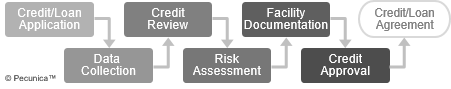

| The Credit Approval Process |

Source:

|

Collectively, the definitions, calculations, documentation, guidelines, standards, policies and other requirements used to determine a transaction’s eligibility criteria and price are underwriting requirements. The underwriting requirements may tighten or loosen relative to the cost of funds for the transaction. Regulations require banks to establish prudent, clear and measurable underwriting standards. Underwriting is the key risk control element in transaction financing.

In order to avoid liability, arrangers require participant lenders to perform their own independent due diligence and credit analysis of the transaction with the information provided. Lead arrangers will typically require representations from each co-lender that the co-lender has done its own credit analysis and made its own decision with respect to joining the syndicate group.

Leave A Comment

You must be logged in to post a comment.