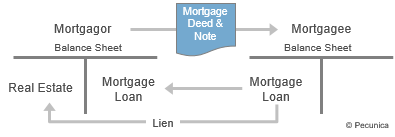

A security interest in real property held by a lender to secure a borrower’s performance in accordance with the terms and conditions of the mortgage loan agreement between a lender and the borrower is a real estate mortgage. A mortgage deed is a document that imposes a lien on the title to real property as security for a loan, it allowing the lender (mortgage holder) to foreclose on the financing if the borrower (mortgagor) fails to repay to the mortgagee the loan or otherwise perform as specified in the mortgage loan agreement. A promissory note secured by a real estate mortgage evidencing the obligation of the mortgagor to repay to the mortgage holder the mortgage loan plus interest at a specified rate and over a specified period in order to fulfill the obligation is a mortgage note.

The mortgagor is the borrower of a mortgage loan, who assigns to the mortgage lender a security interest in real estate owned by the borrower as security for the loan, allowing the lender to foreclose on the loan if the borrower fails to repay the loan or otherwise perform as specified in the mortgage loan agreement. The lender of a mortgage loan is the mortgagee, to whom a security interest in real estate owned by the borrower is assigned as security for the loan, allowing the lender to foreclose on the loan if the borrower fails to repay to the lender the loan or otherwise perform as specified in the mortgage loan agreement.

| Lien Attaching Real Estate (Mortgage) |

Source:

|

The US Unified Commercial Code (UCC) does not cover security interests taken in real property, except fixtures – the personal property attached to real property. Instead, interest in real property collateral is secured under the real property law of each US state, which varies from state to state.

Leave A Comment

You must be logged in to post a comment.