| Debt Subordination (Example) |

Source:

|

Unsubordinated debt is indebtedness that ranks ahead of other unsecured debt with regard to claims on assets and earnings in a liquidation, except for obligations mandatorily preferred by the operation of law (e.g., taxes and wages). Before making a loan, lenders will want to know of any creditors whose claims legally rank senior to the intended loan of the lenders. The pari passu representation and the negative-pledge clause are specifically required for the protection of unsecured and unsubordinated creditors. Unsubordinated debt has general creditor status.

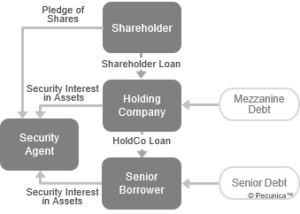

Debt subordination can be structural and/or contractual. The successful syndication of leveraged finance quite often depends on the how the different layers of finance are structurally and contractually subordinated.

Leave A Comment

You must be logged in to post a comment.