| Vendor Lease Transaction |

Source:

|

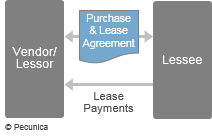

A vendor program involves a working relationship between an equipment vendor and a source of funding in which the lease financing of the product purchase is provided directly by the equipment manufacturer or dealer or indirectly by a bank, captive or independent lessor that underwrites the leases. Captives naturally play a critical role in the vendor leasing programs of many equipment manufacturers and dealers, while bank and independent lessors also actively support vendor programs by underwriting the leases of the vendors and source large volumes of business through vendor programs.

Any bank, captive or independent lessor that engages in vendor leasing and provides lease financing together with the sale of equipment is a vendor lessor. Vendors commonly provide leasing through their captives or as lease brokers source business to the lease underwriters by introducing their customers to them. In vendor leasing, customer relationships are of primary importance to the vendors, while the main aim of the lessors is to finance only creditworthy customers and for whom customer relationships are of less importance.

| New Business Volume by Origination Channel 2012 | ||||

|---|---|---|---|---|

| Vendor Program | Captive Programs | Direct | Third Parties | |

| New Business Volume (bn) | $10.4 | $36.5 | $33.3 | $25.4 |

| Year-on-Year Change (2011 to 2012) | 14.1% | 10.9% | 21.3% | 24.2% |

| Source: White Clark Group | ||||

Vendor programs are especially significant to leasing companies operating in micro- and small-ticket (retail) markets. In these high-volume market segments, the speed, efficiency and convenience of straight-through processing are the decisive benefits provided by lessors in close coordination with channel partners. Introductions for new business through vendor relationships minimize origination costs.

Leave A Comment

You must be logged in to post a comment.