Leases in the upper middle-ticket segment and big-ticket leases are also generally structure as true leases. The ability of lessors to claim the tax benefits of ownership is a key reason for the success of big-ticket leasing, where the capital-intensive nature of the transactions often limits the ability of lessees to take advantage of the tax benefits.

All leveraged leases and most operating leases are true leases. Also, TRAC leases and cross-border leases are commonly structured as true leases to meet the IRS true lease guidelines. However, operating leases can be structured as nontax leases, allowing the lessee to achieve the tax benefits of asset ownership, while preserving the off-balance sheet accounting treatment of the transaction.

| True Leases under US Tax Law |

|---|

| Operating lease |

| Leveraged lease |

| TRAC lease |

| Cross-border lease |

| Syndicated lease assignment |

To preserve the tax characteristics of a true lease, the lessee cannot purchase the asset at a price less than its estimated fair market value. Where a finance lease cannot have a bargain purchase option, a lease can include a bargain renewal option and qualify as a true lease. If the lease contains a fair value purchase option (FVPO) or an early-termination option (ETO) with the lessee having a sale-price guarantee, a nonbargain early-buyout option (EBO) or third-party residual guarantee, it is a true lease and the lessor claims the tax benefits of asset ownership.

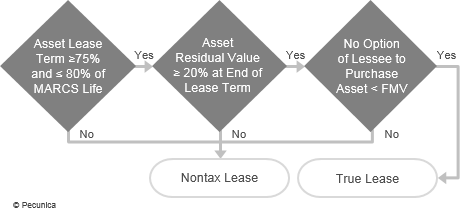

Under US Internal Revenue Service (IRS) guidelines, in order for the lessor to treat a finance lease as a true lease:

- The Lease must have a term of at least 75% but not more than 80% of the asset’s MACRS life;

- The asset must have an estimated residual value of at least 20% of the asset’s cost at the end of the lease term; and

- The lessee cannot have the option to purchase the asset for less than its fair market value.

| US IRS True Lease Decision Tree |

Source:

|

Leave A Comment

You must be logged in to post a comment.