Leveraged leases have a separate accounting classification under US GAAP; IFRS does not have the concept of leveraged leases. Under US GAAP, a leveraged lease qualifies as an operating lease for the lessee and a capital lease for the lessor.

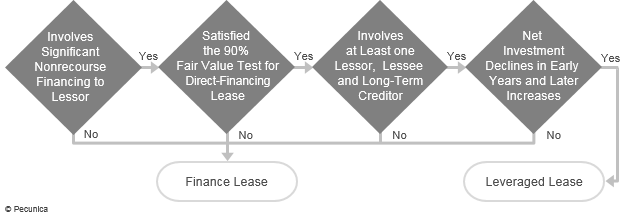

A lease must meet the definition of a direct-financing lease to be accounted for as a leveraged lease. Those that meet the definition of sales-type or operating leases for lessors cannot qualify as a leveraged lease and are treated as a true lease for the lessor and an operating lease for the lessee.

To qualify as a leveraged lease under US GAAP, the transaction must qualify as a capital lease (except for the 90% fair market value criterion) and meet the following three additional criteria:

- Have at least a lessor, a lessee and a long-term creditor in the transaction;

- Have substantial debt financing provided to the transaction by the long-term creditor without recourse to the lessor; and

- Show a decrease in the lessor’s net investment in the lease’s early years and an increase in the later years until the net investment is eliminated.

| Leveraged Lease Criteria Decision Tree |

Source:

|

Leave A Comment

You must be logged in to post a comment.