Any credit activity facilitated by an online electronic platform that matches loans with lender interest is variably called "crowdlending", “loan-based crowdfunding”, “P2P lending” or “marketplace lending”. The lenders that invest in loans via crowdlending platforms are the "crowdfunders", “loan-based crowdfunders”, “peer-to-peer lenders” ("P2P lenders"), or “marketplace lenders”, respectively. The term used generally depends on the jurisdiction where the platform is located.

Crowdlending comprises consumer lending, business lending and property lending in the form of secured or unsecured debt – loan, bond or other type of debtor note. Crowdlending platforms offer online alternative funding and investment opportunities to individuals, businesses and other entities from retail investors and institutional investors.

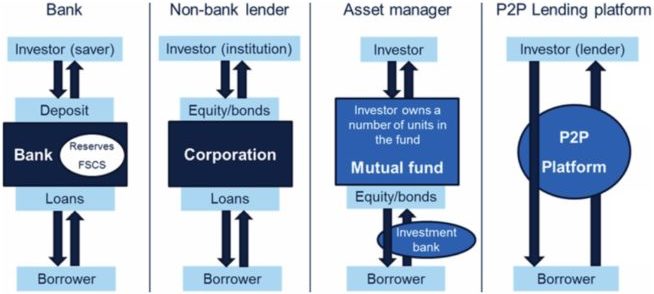

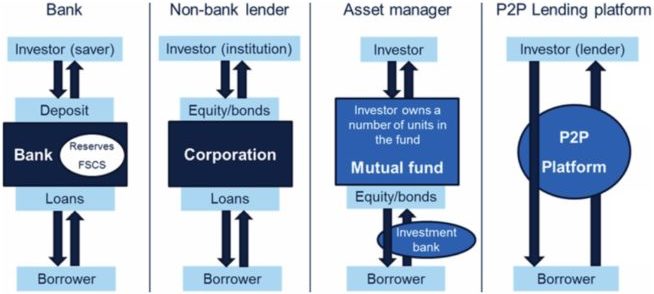

A debt-based crowdfunding platform acts as a marketplace that matches the funding needs of borrowers with the investment interest of investors for a fee. They either allow investors to search and find individual loans or automatically present investment opportunities for them to select from.

The traditional crowdfunding campaign follows the direct model. It allows investors to select individual undivided loans, which leads to low loan diversification and the possibility of only partial achievement of the funding objective of the borrowers.

The diffused model allows a platform to actively allocate funds from investors to different loans, providing lenders risk diversification and borrowers quick funding. Automatic order placement enables investors to set the maximum amount and distribution of their investment according to risk bands, loan maturities and other parameters for automatic execution.

Many platforms provide for the secondary market trading of their loans – in the US, the notes that P2P platforms issue are registered securities. In such cases, the term "marketplace lending" would be appropriately used.

The crowdfunding market is characterized by new technologies, such as blockchain lending and the incorporation of smart contracts – therefore, the term "fintech credit market". Regulatory measures for investor protection are also being implemented and call for adaptation.