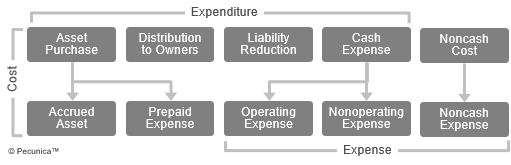

The amount of cash or other asset paid or to be paid for the acquisition of a good, service or other future economic benefit or the incurring of a loss is a cost. Costs that are capitalized are assets. The cost of an asset is determined by the cash paid or required to be paid, market value or other commonly accepted valuation basis.

An expenditure generally refers to the payment of cash or other asset to obtain an asset, service or other future economic benefit or to settle a loss. The term is often used to refer to cost.

| Cost, Expenditure and Expense |

Source:

|

An expense is an amount of money or other asset used up or the incurrence of a liability (or both) in an accounting period in the course of ordinary business activity for the purpose of obtaining revenue. The matching principle requires that it expense is matched to the revenue it generated. Expenses are reflected in decreases in economic benefits in an accounting period in the form of outflows or the reduction of assets or the incurrence of liabilities that result in decreases in equity in carrying out the earnings process, excluding any decreases in equity due to distributions to equity participants. Expenses are costs that have expired or items that have lost future value in the earning process and can be matched to revenue.

A loss is cost for which there is no associated economic benefits (revenue), which is incurred when the revenue obtained on a cost is less than that cost. Losses are to be recognized when it becomes evident that future economic benefits of a previously recognized asset have been reduced or eliminated or a liability has been incurred without any associated economic benefits.

| Expenses vs. Losses | |

| Revenue | No Revenue |

| ↕ | ↓ |

| Expense | Loss |

Leave A Comment

You must be logged in to post a comment.