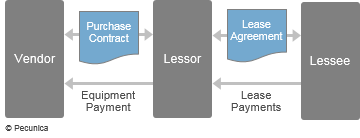

- A contract between the supplier and the lessor for the acquisition of the asset; and

- A lease agreement between the lessor and the lessee for lease of the asset.

| Indirect Leasing |

Source:

|

Because the lease financing is provided directly by the lessor – not the leased asset's supplier, indirect leasing refers to direct-finance leases. A direct-financing lease is a finance-lease arrangement between a lessee and a lessor that is not the manufacturer or dealer (supplier) of the leased asset, whereby the lessor acquires the asset expressly for the purpose of leasing it to the lessee in order to generate interest income through rental payments.

Indirect Leasing = Direct-Finance Leasing

In direct-financing leasing, the lessee selects the asset, the asset’s supplier and the lessor and negotiates with the supplier the purchase contract terms and conditions, including price, delivery, installation and maintenance, while the lessor purchases the asset from its supplier and then leases it to the user. A direct-financing lease exists when the lease is neither an operating lease nor a sales-type lease.

At lease inception, the lessor recognizes a direct-financing lease as a lease receivable equal to the net investment in the lease. The difference between the gross investment and the net investment in the asset is unearned lease income that the lessor amortizes over the term of the lease. In a direct-financing lease, no gain or loss is realized by lessor through the vendor’s sale of leased asset.

| Lessor Recognition of a Direct-Financing Lease | ||||

|---|---|---|---|---|

| Date | Lease Receivable (Gross Investment) | xxxx | ||

| Leased Asset (Net Investment) | xxxx | |||

| Unearned Lease Income (Gross - Net) | xxxx | |||

| To record a finance lease at inception | ||||

Leave A Comment

You must be logged in to post a comment.