An asset’s acquisition may involve progress payments, which are payments made to the manufacturer or constructor of the asset to be leased in its predelivery phase as it is being produced to cover the cost of materials and the asset’s manufacturing or construction. While in some cases the predelivery period may be a few months, in others the period may extend over several years. Progress payment commonly takes either of two forms:

- Predelivery rentals – Lease progress payments made by the lessee for the cost incurred by the lessor for the asset’s manufacture or construction during the predelivery period, with payment usually commencing on the date the leased asset is ordered and calculated based on the anticipated cost of the asset; and

- Capitalizing interest – The recognition of the total interest incurred by the lessor on progress payments made to a manufacturer or constructor until the asset’s delivery by “rolling-up” (capitalizing) the interest to the asset’s cost in calculating the payments on a lease and its carrying value in the balance sheet.

| Lessee Capitalization of Interest on Asset under Construction | ||||

|---|---|---|---|---|

| Date | Asset under Construction | xxxx | ||

| Interest Expense | xxxx | |||

| To capitalize interest paid on asset under construction | ||||

Progress payment financing, which is funding of an asset provided by a bank or the lessor while it is being manufactured or constructed to cover the cost of production during the predelivery period, allows lessees to minimize the amount of their own capital that is tied up prior to asset delivery. The principal amount borrowed is generally applied to the asset’s permanent financing, whether by way of an operating lease, a finance lease or otherwise.

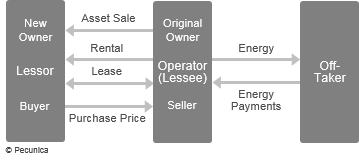

Progress payments are commonly used for big-ticket leasing involving a sale-leaseback-before-use, where the lessee places the order for an asset, makes the progress payments and then sells to the lessor title to the asset immediately before the asset is brought into use. Commercial real estate leasing commonly includes the progress payment financing of the construction or acquisition of income-producing real estate. The lessee is responsible for the asset’s manufacture or construction according to the lessee’s specifications. Its accounting treatment depends on whether the transaction qualifies as a finance or operating lease.

| Sale-Leaseback in an Energy Project Financing |

Source:

|

Leave A Comment

You must be logged in to post a comment.