- The objectives of the developer, its investors and the other stakeholders;

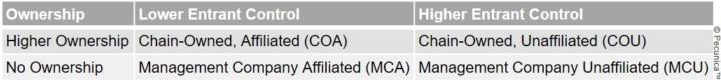

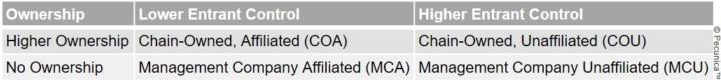

- Control over the project's marketing and operations throughout its extended life cycle

- The strengths, weaknesses, opportunities and threats of the development project;

- The brands, products or services to be supplied;

- The pricing policy and price sensitivity;

- The competition, their strategies, and any competitive advantage of the project;

- The profile of the prospective guests; and

- External influences that are likely to affect the market.

Build-to-hold is a basic business strategy to develop income-producing property that the developer owns (holds), commonly with other investors, and to manage over the long-term. Build-to-sell is the other basic strategy where hotel property is developed, sold and transferred upon project completion, marking the developer's exit from the project.

Property development projects create value for developers through five basic operational strategies:

- Development or redevelopment – When the total cost is lower than the asset’s market value upon project completion, profit is realized;

- Lower cost of capital – When financing is favorable, developers can outbid competitors while increasing leverage;

- Financial leverage – Through the use of debt funding to finance the business, the return on equity (ROI) increases;

- Superior investing skills – Using systematic selection procedures and market-timing strategies, good deals are sought and bad deals avoided; and

- Superior operating skills – When operated more efficiently than competitors, revenue is enhanced and superior net operating income (NOI) is produced.

The strategies are generally combined. Each requires different skill sets and has different implications for a project’s overall risks and returns.

Sustainability as a business strategy calls for consideration of the prevailing and changing social and cultural norms, values and practices. Sustainable development is undertaken for the benefit of all stakeholders.