Investors in hotel property own the site and building for the hotels, receive the return on their investment and bear the risks of property ownership. Whether they are also hotel owners depends on their business strategy.

The owners of the hotel businesses are the hotel owners, who occupy and use the hotel properties and profit from their operation. The degree of management and control they desire over the management and operation of the properties determines a hotel's business strategy and operating model.

Developers typically exit development projects post-construction through their sale to real estate investors, frequently using forward sales before project completion. Private-equity sponsors commonly invest in hotel properties when the projects are initiated with the intention to hold the properties in their managed investment portfolio.

Hotel investors often hire hotel asset managers to control and influence the decisions of third-party operators. Where asset managers assist them in achieving greater involvement in the management of their hotels, the investors remain passive with regard to hotel operating decisions.

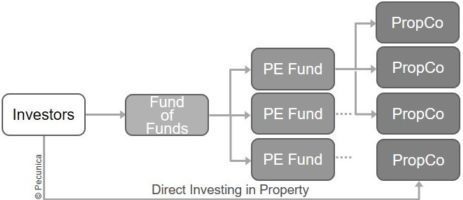

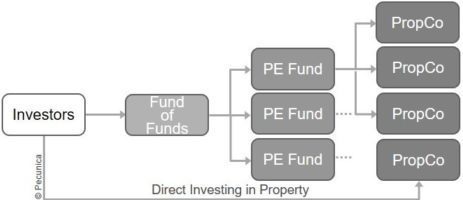

The investment in hotel properties largely depends on the investment structure and vehicle. (REITs) and private equity funds have led to significant changes in hotel property ownership structures and the interest of institutional investors in hotels.

The asset-light strategy is to hold a reduced portfolio of properties in favor of lighter portfolios, achieved through franchising, sale-leaseback, and management agreements. It allows hotel companies to develop and increase business with limited requirements for capital and focus on fee revenues while generating higher returns on invested capital.

A hotel's business strategy establishes the form of property and business ownership and the influence the owners have on property-level decisions and hotel operations. When hotel ownership is separated from operational management, the resulting conflict of interest leads to the agency problem.